Quick: do you know how much money you’ll make this month?

If you work a salaried job, it’s probably not too hard to come up with that number. By definition your monthly income is predictable.

But what if you’re a freelancer? Or you have a side gig? Maybe you work an hourly job — or multiple jobs. As an hourly employee, you may work regular shifts and at least have a general idea of how much you’ll bring in. But what if you got let go early a few days last week when things were slow? That can be hard to remember later when your paycheck arrives. Cue sad trombone.

As a freelancer or small business owner, predicting your income can sometimes feel like you’re spinning a fortune wheel at the county fair. Some months you’ll be flush with cash and other months you might be eyeing the cat food for dinner.

In this post, I’ll show you how predicting your monthly income can reduce your stress and potentially increase your revenue.

How knowing your income helps

Of course, simply knowing how much money you’ll make this month doesn’t change the amount. The mere knowledge that you’ll be short on rent won’t magically solve that problem.

However, knowing where you stand gives you the power to plan. Maybe you can’t take on more hours at your job, and you can’t force clients to show up needing your services. But knowing the lay of the land allows you to move forward with the lights on instead of fumbling in the dark. Don’t hit your shins on the proverbial coffee table — turn on the light!

Knowledge is power. Being able to confidently say how much money is coming in this month is a form of power, and in many ways can be a stress reliever. Feeling helpless causes stress, but knowing what you can control and letting go of what you can’t eases your mental burden. Maybe you don’t yet know where the extra cash is going to come from. Knowing you’ll need it before the 31st arrives can give you more time to figure things out.

So how can you know? Simple. Start keeping track, right now.

Record your income

Keeping an eye on your bank account for deposits is great. But to better predict what’s coming this month and the next, you need to make a record — something you can track easily.

That means you’ll need to record all income you’ve already earned or know for sure will be hitting your account in the next 30-60 days. I call it my “pipeline” and throughout the month I take a look to see what’s flowing. For example, if I sent an invoice for work I performed for a client, I record that as income that I expect to receive. You can do this, too! If you know you worked 30 hours two weeks ago, count that as income this month. If your Money Market account earned interest this month, put it in. Rent from tenants, products you sold at the local market, music lessons you gave, it all flows through your income pipeline.

The good news is that you don’t need to buy or use complicated software to record and track your income. It can be as simple as writing it on a piece of paper. But if you want to make it easier on yourself and have a better visual on your predicted income, I suggest using a spreadsheet.

Using a spreadsheet to track your income

For the uninitiated, a spreadsheet might sound like a huge hassle. Maybe you’re not familiar with using spreadsheets and they might seem a little scary. The toolbar tends to look like the controls of a fighter jet. Thankfully, there are a lot more tools you’ll ignore than you’ll actually use. If you need a refresher or an easy tutorial on basic spreadsheet use, try this one from Lido.

Excel, Google Sheets, Numbers, LibreCalc — it doesn’t matter what app you use. You can make a simple income tracker! Here’s how to do it.

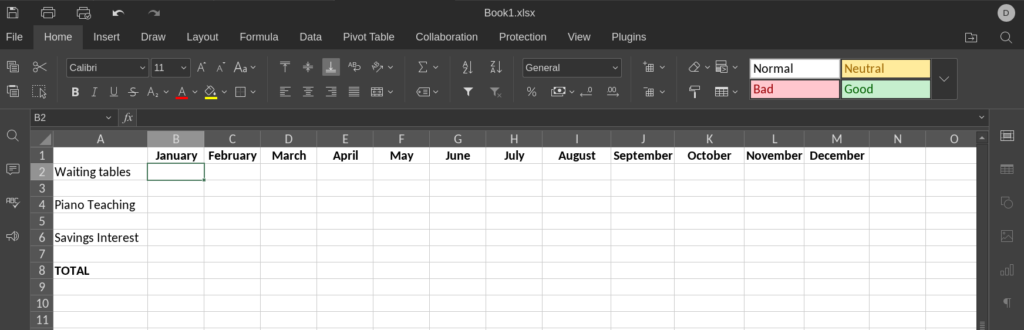

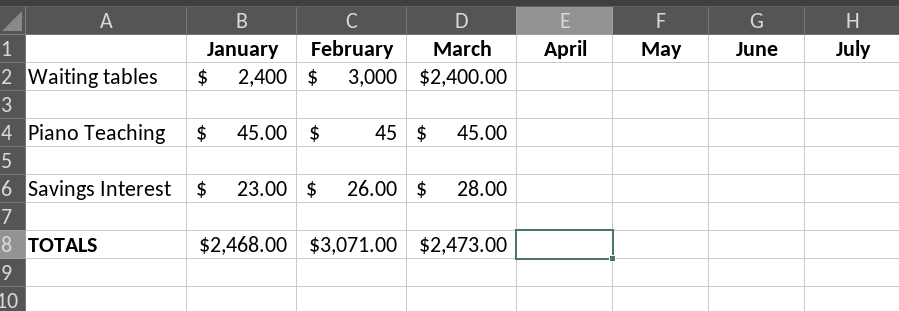

First, think about what you need to record and how you’ll record it. You’ll probably want to track income by month. So in the top row, add a month in each column — but skip column A.

Then in Column A, starting in row 2, list your sources of income. In the last row, create a cell called TOTALS.

Throughout the month, enter the income you expect to receive from each of your sources as soon as you know what it will be. Total it up in the TOTALS row. It’s that simple. If you want to get fancy, you can enter a formula in the TOTALS row that automatically adds income as you update it. It depends on the application you use, but every app has a simple SUM formula or function. Automation makes life easier.

Once you have it working, you can make it pretty. Or not. It’s up to you.

Updating the spreadsheet

This single-tab pipeline spreadsheet is all you need to track your income. As the month moves along, keep updating your income sources and check the totals. This super simple method is what helps you better predict your income. It gives you a visual on data, allowing you to assess and take action if you need to boost your income that month. Maybe you need to take another shift at the store, or bring in another student. It may not be as easy as that, but at least you know exactly where you stand.

Eliminating mystery is the key to taking charge of your financial life. If you can see it, you can address it. I’ve been using this exact same spreadsheet method for fifteen years. It’s radically changed the way I see my monthly income and has helped me better plan how to bring in more when I need it.

Use a preformatted spreadsheet calculator

What if you’re not a spreadsheet geek like me? You can still do this! If you don’t have time (or the inclination) to mess around with formulas and formatting a spreadsheet, you’re in luck.

I’ve been using this method for years, so I’ve had plenty of time to mess around with the functionality. And yeah, I also made it really pretty. And now I’m sharing my own personal income predicting spreadsheet with you.

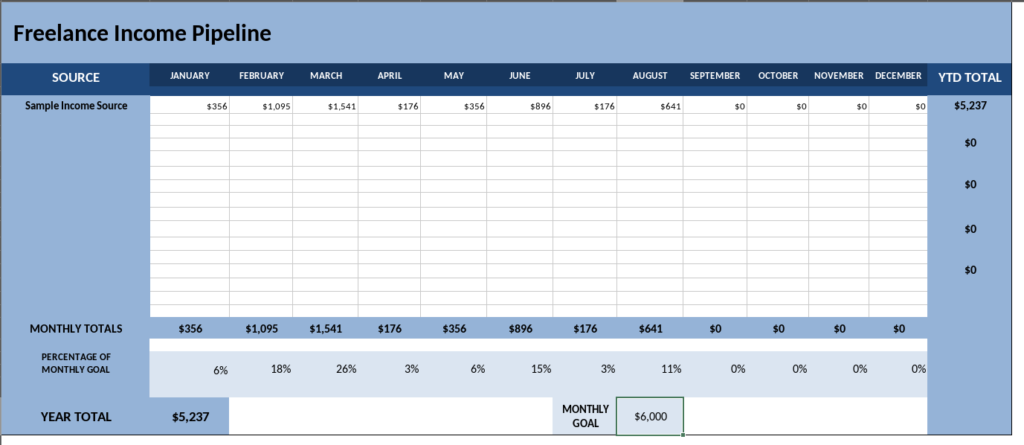

I’ve added lots of functions, tabs, and formulas that make it super easy to enter income and get a bird’s eye view of every month and my entire year. I have a separate tab for each type of income source. Because I’m a freelancer and small business owner, I have several streams of income I need to track every month. But even if you have only one source, my new format makes everything clean and easy to manage.

It works like this:

- On an income source tab, enter the expected income for the month.

- It automatically updates the main pipeline tab!

- You can even enter a monthly goal, and each month your pipeline will show you the percentage you’ve achieved. Magic!

If you just want to dive in and get started recording your income without toiling over a spreadsheet, then my pipeline is ready for you. Plus, it comes complete with instructions.

This is what I use every day to better predict my income. When I know what my monthly income will be, I can start making changes much sooner if I need to. And you can do it, too!

Photo by Alexander Grey on Unsplash

Leave a Reply